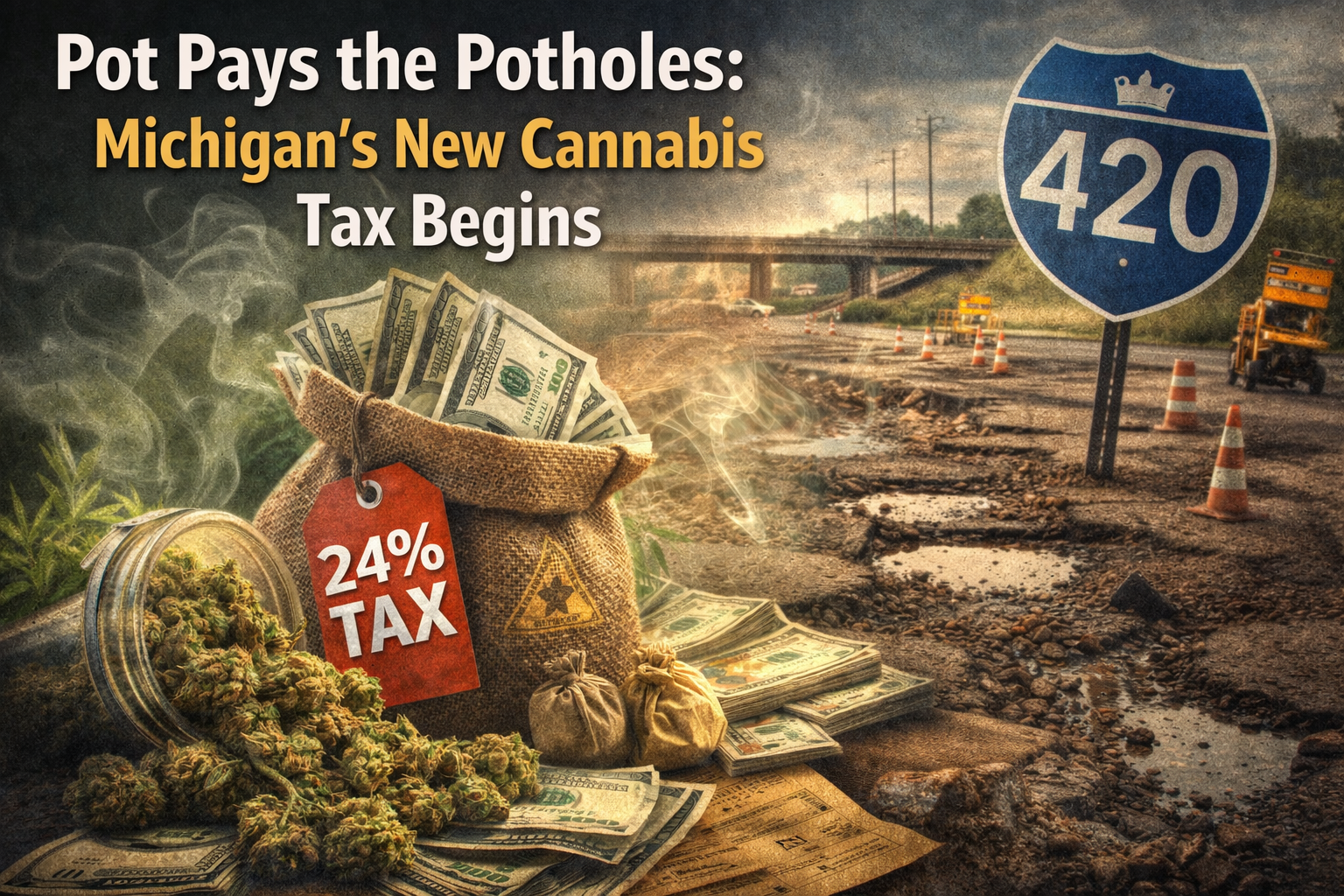

(LANSING) - Michigan's legal marijuana market faces a major shift starting January 1, as a new 24 percent wholesale excise tax on adult-use cannabis transactions officially takes effect.

The tax was approved as part of the Comprehensive Road Funding Tax Act, signed into law in October by Governor Gretchen Whitmer. State officials estimate the measure will raise approximately $420 million each year to fund road and infrastructure repairs.

The tax applies when marijuana products are sold from cultivators or processors to retailers. It is assessed in addition to Michigan's existing 10 percent retail marijuana excise tax and the state's 6 percent sales tax, making Michigan one of the highest-taxed cannabis markets in the country.

The move has drawn strong opposition from industry groups, including the Michigan Cannabis Industry Association, which argues the new tax conflicts with the voter-approved marijuana legalization initiative that intentionally kept taxes low to undercut the black market.

Legal challenges seeking to stop the tax were unsuccessful, after a Michigan Court of Claims judge declined to block its implementation.

Industry analysts and cannabis business owners say consumers may not feel the price impact immediately. Marijuana products already in retail inventory before January 1 are exempt from the new tax, meaning higher prices are expected to appear gradually as newly taxed inventory reaches store shelves.

Critics warn the increase could push some consumers back to illegal marijuana sources, while supporters argue the tax is necessary to address long-standing infrastructure needs across the state.